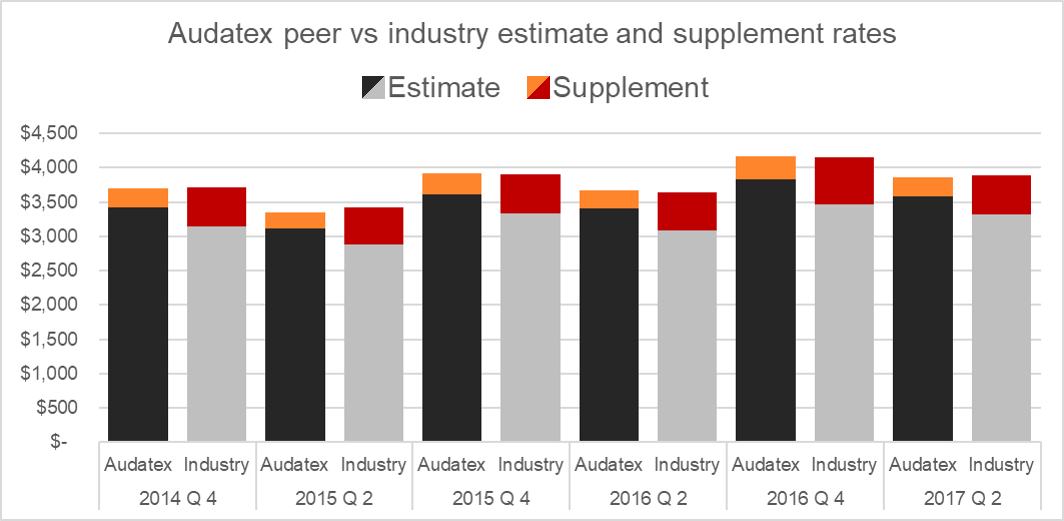

As insurers are well aware, supplements are a major source of friction during the claims process—impacting cycle time, staff labour—especially reviewers, and even the payment process. Granted, although getting the estimate right the first time is the ultimate objective, supplements will always be necessary in many cases: part price changes, additional damage found at teardown etc.

We asked the question, is the supplement rate changing and are supplement costs improving? Using data provided by Audatex Insight as well as recently published industry data1, we analyzed supplement rates over the past few years. At best, we can say that there have been modest improvements.

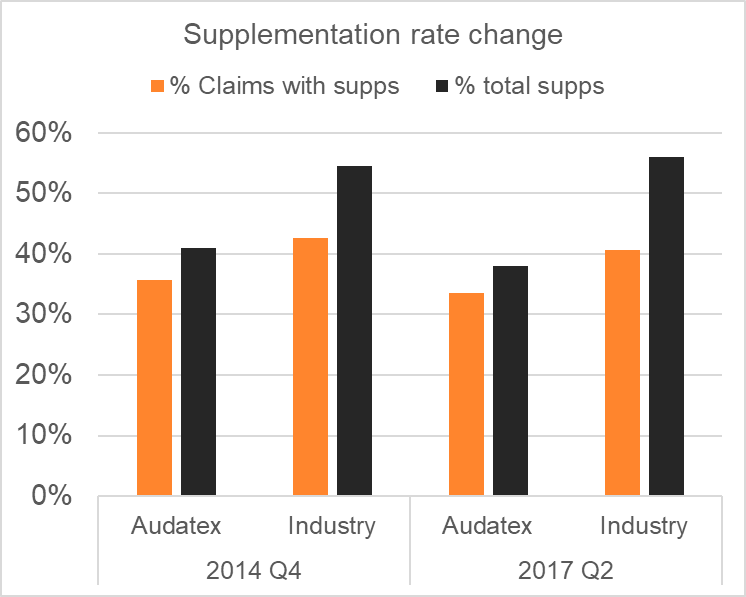

The supplement rate is marginally lower between 2014 and Q2 2017. For the Canadian industry, 41% of all claims had supplements in Q2 2017, down 2% from Q4 2014.

Among Audatex estimators, 34% of all claims had supplements, down 2% as well. For the industry, there were 56 supplements for every 100 estimates, while Audatex insurers averaged 38 in Q2 of this year.

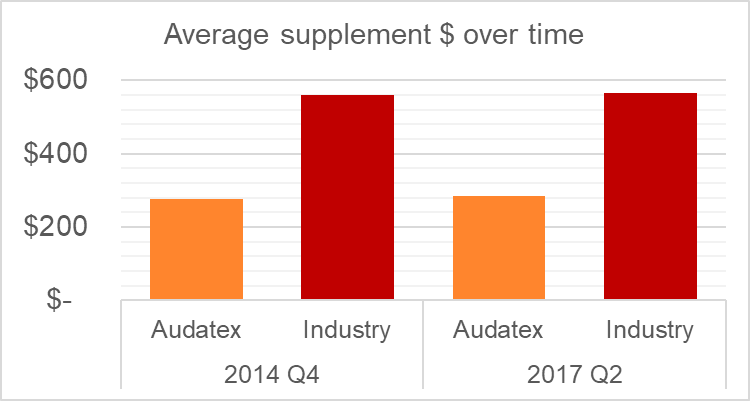

From a cost perspective, supplements across the entire Canadian industry totaled $567 in the most recent quarter, which is an $8 increase from 2014. Similarly, among Audatex insurers, supplements averaged $283 in Q2 2017—a $6 increase in three years—which is less than inflation.

The Audatex Professional Services team would be pleased to provide a more detailed analysis of variables that impact supplement rates. Please contact us here.

1 Source: Audatex Insights data and Industry Trend Report Q3 2017; may exclude some insurers for privacy reasons